Full paper available at the International Review of Financial Analysis, March 2023 (open access)

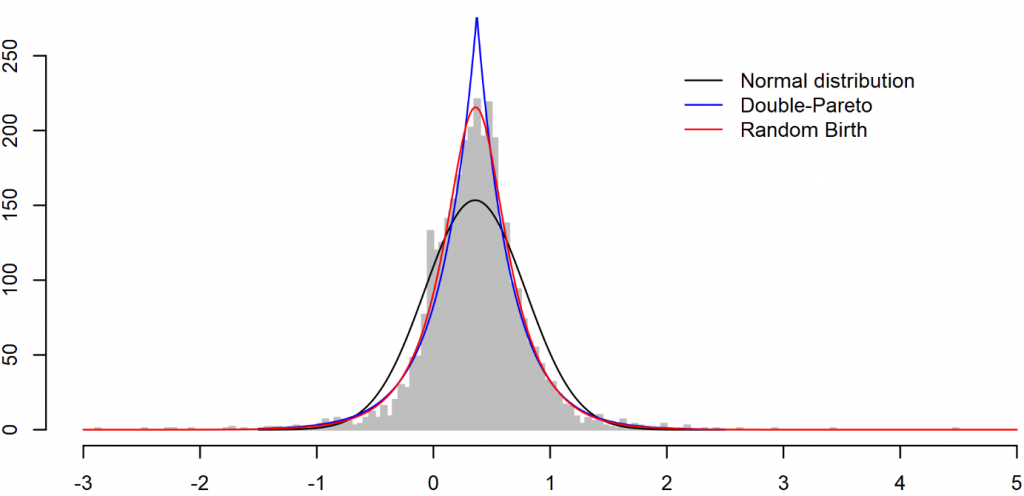

Does the distribution of private equity returns have fat tails? A new smooth double Pareto distribution can explain the stationary distribution of private equity funds’ valuation multiples. This distribution emerges from a random growth model with lognormally distributed initial fund valuations. This model endogenously generates power-law tails in the stationary cross-section. The new distribution fits the data better than competing distributions. Fat tails are particularly pronounced in venture capital funds and suggest returns with infinite variance over the lifetime of the fund. The smooth double Pareto distribution has wide applicability to growth processes with a random initial value.

R code to estimate the smooth double Pareto distribution is available on request.

I have also written a more general take on the subject of the Return Distribution in Private Equity for the Palgrave Encyclopedia of Private Equity.