The research papers you find here span topics in financial economics, industrial organisation and related areas: financial constraints to investment and innovation, innovation dynamics in entrepreneurial firms, listed private equity, venture capital and buyout fund pricing, efficient capital markets, quantitative methods in accounting and finance.

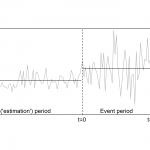

A simple event study test for volatility with an application to coup d'états

With Yarema Okhrin and Tomasz Wisniewski, available at SSRN. Event studies in finance typically estimate the effects of corporate or macroeconomic events on mean returns of stocks or portfolios. While effects on mean returns have been studied extensively, a commonly accepted and widely used method for the volatility of returns does not currently exist, owing … Read More

With Yarema Okhrin and Tomasz Wisniewski, available at SSRN. Event studies in finance typically estimate the effects of corporate or macroeconomic events on mean returns of stocks or portfolios. While effects on mean returns have been studied extensively, a commonly accepted and widely used method for the volatility of returns does not currently exist, owing … Read MoreStock price synchronicity under fat-tailed stock returns

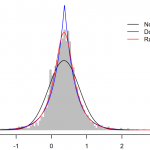

This paper addresses a subtle but important assumption in the broad literature on stock price synchronicity, that is, whether the standard errors used in hypothesis testing are well defined. Findings of relationships between synchronicity and explanatory variables are often unstable or reverse their sign in subsequent research using a different time period. This paper offers a simple explanation for these contradictory findings. Research into stock price synchronicity has a kurtosis problem. As a consequence, results in research using R-squared as a dependent variable are suspect. Estimation of stock price synchronicity typically requires the kurtosis of underlying firm-specific returns to be finite, but a large proportion of stocks is likely to have infinite or undefined kurtosis, which invalidates estimates of synchronicity for these stocks. Therefore, stock price synchronicity cannot be known in general and may be estimated only if finiteness of kurtosis can be established.Read More

This paper addresses a subtle but important assumption in the broad literature on stock price synchronicity, that is, whether the standard errors used in hypothesis testing are well defined. Findings of relationships between synchronicity and explanatory variables are often unstable or reverse their sign in subsequent research using a different time period. This paper offers a simple explanation for these contradictory findings. Research into stock price synchronicity has a kurtosis problem. As a consequence, results in research using R-squared as a dependent variable are suspect. Estimation of stock price synchronicity typically requires the kurtosis of underlying firm-specific returns to be finite, but a large proportion of stocks is likely to have infinite or undefined kurtosis, which invalidates estimates of synchronicity for these stocks. Therefore, stock price synchronicity cannot be known in general and may be estimated only if finiteness of kurtosis can be established.Read MoreFat tails in private equity fund returns: The smooth double Pareto distribution

A new smooth double Pareto distribution can explain the stationary distribution of private equity funds’ valuation multiples. Fat tails are particularly pronounced in venture capital funds and suggest returns with infinite variance over the lifetime of the fund. The smooth double Pareto distribution has wide applicability to growth processes with a random initial value.Read More

A new smooth double Pareto distribution can explain the stationary distribution of private equity funds’ valuation multiples. Fat tails are particularly pronounced in venture capital funds and suggest returns with infinite variance over the lifetime of the fund. The smooth double Pareto distribution has wide applicability to growth processes with a random initial value.Read MoreEstimating the value of an inflation-capped pension from market data

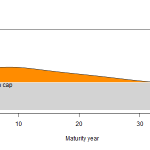

The University Superannuation Scheme (USS) is planning to introduce a cap of 2.5% for inflation adjustments to its members’ accrued pensions. The effect of this cap is to increase new accrued pension benefits in line with official consumer prices (CPI) but only up to 2.5% per year. If inflation runs hotter than 2.5%, that year’s … Read More

The University Superannuation Scheme (USS) is planning to introduce a cap of 2.5% for inflation adjustments to its members’ accrued pensions. The effect of this cap is to increase new accrued pension benefits in line with official consumer prices (CPI) but only up to 2.5% per year. If inflation runs hotter than 2.5%, that year’s … Read MoreEndogenous financial constraints and innovation

with Andrea Mina Industrial and Corporate Change, 2020, full version available from the journal. Abstract: We investigate which indicators of a firm’s innovation activities are associated with financial constraints and analyze the nature and direction of causal links between innovation and financial constraints. By estimating simultaneous bivariate probit models on data from the UK Innovation … Read MoreEarly indicators of fundraising success by venture capital firms

with Timothy E. Trombley Journal of Corporate Finance 65, full paper available here. Abstract: In this paper, we show how a venture capital firm’s fundraising is affected by its investment choices. We investigate three leading indicators that are calculated from the types of investments the venture capital firms make: style drift investments, follow-on investments, and … Read MoreThe impact of business accelerators and incubators in the UK

BEIS Research Paper Number 2019/009 with Jonathan Bone, Juanita Gonzalez-Uribe and Christopher Haley The fast-developing ecosystem of accelerators and incubators has positive effects on startups and the wider economy. Most startups (over 60%) consider the contribution of the incubator or accelerator they attended to have been significant or even vital to their success. Of startups … Read MoreThe Pecking Order of Innovation Finance

with Andrea Mina; available at SSRN. Abstract: This paper examines the relationship between firms’ innovation activities and the hierarchy of financing behaviours. We analyse the role of innovation inputs (R&D), intermediate outputs (patents) and outcomes (product and process innovations) as sources of information asymmetry in financing decisions. Our focus on mainly unlisted companies allows us to … Read MoreTakeover law to protect shareholders: Increasing efficiency or merely redistributing gains?

Journal of Corporate Finance, Volume 43, 2017, Pages 288–315. Accepted manuscript available here.

with Ying Wang

Abstract: We construct a dynamic takeover law index using hand-collected data on legal provisions and empirically examine the effect of takeover regulation to protect shareholders on shareholder wealth for bidders and...Read More

Venture capital investments and the technological performance of portfolio firms

Research Policy, Volume 45, Issue 1, February 2016, Pages 303–318 (Open Access)

with Andrea Mina

Abstract: What is the relationship between venture capitalists’ selection of investment targets and the effects of these investments on the patenting performance of portfolio companies? In this paper, we set out a modelling...Read More

Liquidity, Technological Opportunities, and the Stage Distribution of Venture Capital Investments

Financial Management, Volume 43, Issue 2, pages 291–325, Summer 2014 (Open Access).

with Andrea Mina

Abstract: This paper explores the determinants of the stage distribution of European venture capital investments from 1990 to 2011. Consistent with liquidity risk theory, we find that the likelihood of investing in earlier stages increases relative...Read More

Dynamic financial constraints and innovation: Evidence from the UK innovation surveys

with Andrea Mina

Abstract: Does innovation cause financial constraints? And how do financial constraints affect firm innovation activities? In this paper we address the challenge of separating bi-directional causal effects in the relationship between innovation and financial constraints. Using the longest panel that can to date be derived from the UK...Read More

Signalling, absorptive capacity and the geographic patterns of academic knowledge exchange

with Alan Hughes and Michael Kitson

Abstract: In this paper, we investigate the geographic distance in collaborations between academics and external organisations across different knowledge exchange channels. This analysis is based on a unique large sample of UK academics. We ask the following questions. First, how far does academic knowledge, explicit...Read More

Venture capital in Europe

with Andrea Mina

Abstract:Venture capital has been identified as a key enabler of growth in modern knowledge-based economies and has figured prominently in the European innovation policy debate. Its challenges remain, however, substantial. Firstly, private equity markets are still very unevenly developed across the European region. Secondly, they are...Read More

The Demand and Supply of External Finance for Innovative Firms

Industrial and Corporate Change (2013) 22 (4): 869-901 (Open Access)

with Andrea Mina and Alan Hughes

Abstract: Access to finance has figured prominently in the debate on barriers to firm growth, even though existing empirical research has not found conclusive evidence of a ‘finance gap’. Moreover, it is not clear...Read More

An Improved Test for Earnings Management Using Kernel Density Estimation

European Accounting Review, Volume 23, Issue 4, 2014, pp. 559-591.

Abstract: The methods proposed by Burgstahler and Dichev (1997) and Bollen and Pool (2009) to test for earnings management have been used extensively in the literature. This paper proposes a more general test procedure based on kernel density...Read More

Net Asset Value Discounts in Listed Private Equity Funds

with Christoph Kaserer

Abstract: This paper investigates determinants and consequences of net asset value discounts in listed private equity funds. Listed private equity funds share characteristics of closed-end mutual funds and traditional unlisted private equity funds and can therefore offer insights into both. Our results have particular relevance to the...Read More

The Time-Varying Risk of Listed Private Equity

Journal of Financial Transformation, Vol. 28, pp. 87-93, 2010

with Christoph Kaserer, Valentin Liebhart, Alfred Mettler

Abstract: Structure and stability of private equity market risk are still nearly unknown, since market prices are mostly unobservable for this asset class. This paper aims to fill this gap by analyzing market risks...Read More

Organizational Forms and Risk in Listed Private Equity

The Journal of Private Equity, Vol. 13, 89-99, Winter 2009

with Florian Herschke

Abstract: This paper investigates the stock performance of listed private equity vehicles which are grouped into subsamples according to their organizational structure. We identify 274 liquid listed private equity entities in the period from 1986 to 2008....Read More

Uncertain Private Benefits and the Decision to Go Public

with Olaf Ehrhardt

Abstract: This paper focuses on the decision to go public when both seller and potential buyers have private benefits of control. The basic model by Zingales (1995) is extended to account for uncertainty of private benefits. This leads to new implications for the sales process, ownership structure,...Read More