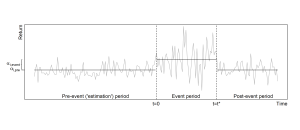

With Yarema Okhrin and Tomasz Wisniewski, available at SSRN. Event studies in finance typically estimate the effects of corporate or macroeconomic events on mean returns of stocks or portfolios. While effects on mean returns have been studied extensively, a commonly accepted and widely used method for the volatility of returns does not currently exist, owing …

Stock price synchronicity under fat-tailed stock returns

This paper addresses a subtle but important assumption in the broad literature on stock price synchronicity, that is, whether the standard errors used in hypothesis testing are well defined. Findings of relationships between synchronicity and explanatory variables are often unstable or reverse their sign in subsequent research using a different time period. This paper offers a simple explanation for these contradictory findings. Research into stock price synchronicity has a kurtosis problem. As a consequence, results in research using R-squared as a dependent variable are suspect. Estimation of stock price synchronicity typically requires the kurtosis of underlying firm-specific returns to be finite, but a large proportion of stocks is likely to have infinite or undefined kurtosis, which invalidates estimates of synchronicity for these stocks. Therefore, stock price synchronicity cannot be known in general and may be estimated only if finiteness of kurtosis can be established.

Fat tails in private equity fund returns: The smooth double Pareto distribution

A new smooth double Pareto distribution can explain the stationary distribution of private equity funds’ valuation multiples. Fat tails are particularly pronounced in venture capital funds and suggest returns with infinite variance over the lifetime of the fund. The smooth double Pareto distribution has wide applicability to growth processes with a random initial value.

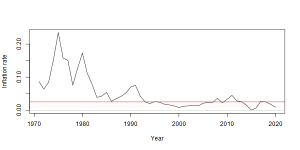

Inflating away your pension — 2021 update

This is an update to my earlier estimate of the effects of an inflation cap on USS pensions. I have added the two most recent years of CPI data and extended the time series of inflation by added earlier years from 1971, the year of the Nixon shock and the de-facto end of the Bretton …

Estimating the value of an inflation-capped pension from market data

1 November 2021

The University Superannuation Scheme (USS) is planning to introduce a cap of 2.5% for inflation adjustments to its members’ accrued pensions. The effect of this cap is to increase new accrued pension benefits in line with official consumer prices (CPI) but only up to 2.5% per year. If inflation runs hotter than 2.5%, that year’s …

Continue reading