The full paper is available at SSRN (this version: 17 November 2025).

The extensive literature on stock price synchronicity, also known as stock price informativeness, implicitly assumes that the sample R-squared of stock return regressions equals its population value, which is a justified assumption under normally distributed returns. However, the non-normality of stock returns is a well-established empirical fact. This paper examines the impact of high and possibly infinite kurtosis on measures of stock price synchronicity. It demonstrates that variables believed to increase synchronicity by reducing firm-specific risk may, instead, elevate kurtosis, which can mimic low firm-specific risk in small samples. A simulation of synchronicity under fat-tailed firm-specific returns reveals that fat tails cause the variance of firm-specific returns to be underestimated in small samples, thereby inflating stock price synchronicity. This upward bias is particularly pronounced when stock returns exhibit infinite kurtosis. The bias in synchronicity estimates is comparable in magnitude to main effects of variables examined in the synchronicity literature. An empirical analysis of firm-specific returns identifies a large proportion of stocks with fat-tailed returns within the region where kurtosis is infinite. Further empirical results indicate that fat-tailedness is associated with firm size, Tobin’s q, and industry sector. These and other variables linked to a firm’s growth potential and crash risk may thus confound analyses of stock price synchronicity by making stock returns appear to have low variance when, in reality, they exhibit high kurtosis.

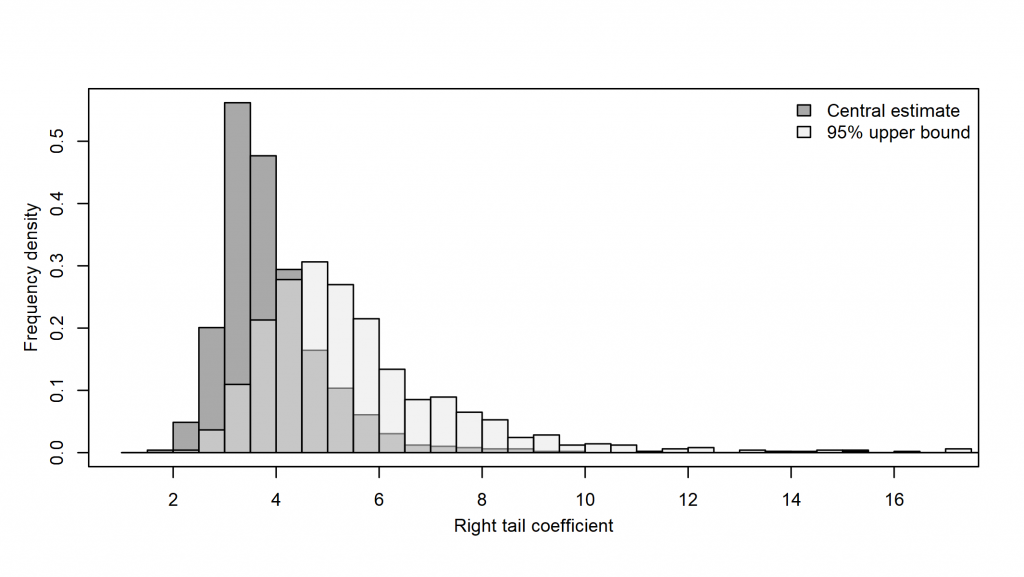

This graph shows the absolute value of tail coefficients (i.e., tail indices). Dark bars show the central estimate of coefficients, while light bars show the upper 95% single-sided confidence interval for the same coefficients. Coefficients greater than 17 are not shown. Coefficients less than or equal to 4 cause estimates of stock price synchronicity to be invalid (i.e., kurtosis of firm-specific returns is infinite).