With Yarema Okhrin and Tomasz Wisniewski, available at SSRN.

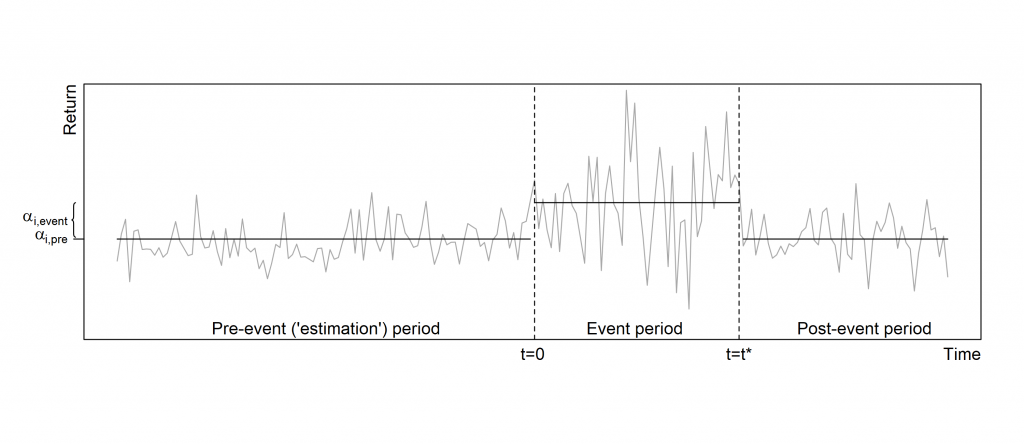

Event studies in finance typically estimate the effects of corporate or macroeconomic events on mean returns of stocks or portfolios. While effects on mean returns have been studied extensively, a commonly accepted and widely used method for the volatility of returns does not currently exist, owing in part to implementation complexity. In this paper, we offer a simple solution to testing volatility in an event-study framework by reinterpreting the Breusch-Pagan heteroskedasticity test and Koenker’s robust version. These tests are readily available through standard statistical software and can easily be implemented in spreadsheet software. A power analysis shows that these methods have a reasonable power to detect changes in the volatility of stock returns within a plausible range and that Koenker’s test is robust to non-Gaussian returns. Applying these tests at the country level in an event study of coup d’états reveals a significant increase in the volatility of stock index returns in a period of up to 15 days after an attempted or successful coup d’état, with the magnitude depending on the nature of the coup.